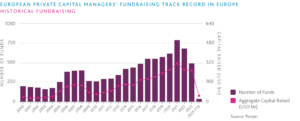

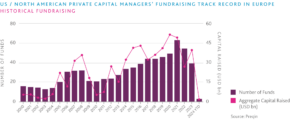

It is therefore not surprising that US managers are increasingly targeting this region. However, to attract European investors, managers need more than just a compelling track record.

Identifying the right marketing strategy

Firstly, managers need to think carefully about their marketing strategy.

US private capital managers can access EU investors through one or more of the following channels:

- National Private Placement Regimes (NPPRs)

- By establishing an AIFM (Alternative Investment Fund Manager) themselves or using a third-party AIFM

- Reverse solicitation

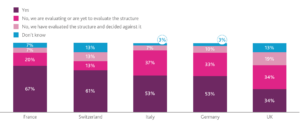

Under the Alternative Investment Fund Managers Directive (AIFMD), US private capital managers can leverage the NPPR, which lets them register their fund(s) in a specific EU member state(s) for marketing purposes. Although NPPR is restricted in certain EU countries (e.g. France), this approach is a sensible one for managers to take, providing they are only targeting investors located in a handful of member states.

Alternatively, some managers may choose to either launch an AIFM or use a third-party AIFM ManCo, both of which enable managers to distribute their products on a pan-EU basis. Setting up an AIFM can be a costly process for managers, which is why so many choose to use third-party ManCos. A ManCo lets managers market their funds cross-border into the European member states without having to invest in the physical infrastructure that comes with running an AIFM. It also gives fund managers access to high-quality resources — people with hands-on portfolio management experience, risk management professionals and governance professionals. Alongside the requirement for an AIFM, each AIF will also need to appoint an independent depositary to safekeep the fund’s assets, perform oversight duties and monitor the fund’s cash flow.

For asset managers not yet established in Europe, pre-marketing has also become a popular solution for those wishing to perform cross-border marketing and are contemplating launching a European investment fund, as it gives the opportunity to test investors’ appetite for their strategies at a limited cost, provided that they are facilitated by an AIFM.

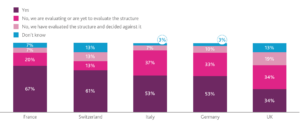

The final option is to rely on reverse solicitation.

This is loosely defined as when an investor directly and independently reaches out to a fund promoter seeking information about a fund. Despite its cost benefits – reverse solicitation has the potential to cause compliance issues, and only tends to benefit larger managers who have pre-existing relationships with European investors. However, even for larger managers ESMA has reminded the industry that solely depending on reverse solicitation is not a feasible marketing strategy7.

Consequences of relying solely on reverse solicitation could potentially include regulatory sanctions, loss of investor trust, reputational damage, and potential legal actions.

Choosing your structure

If a manager chooses the AIFM route, they have the freedom to domicile their fund in any EU jurisdiction. However, most non-EU managers targeting EU investors will usually domicile their funds onshore in one of either Ireland or Luxembourg, both of which offer suitable and tested fund structures and have a local services industry with extensive experience in fund structuring and fund servicing. It is important, nevertheless, to understand the preferences of the underlying investor base before settling on a jurisdiction and structure for a fund.

Ireland

Ireland is now the third largest investment fund centre in the world, and the second largest in Europe (behind Luxembourg). The major benefit of Ireland as a fund domicile of choice is the full funds product coverage across UCITS, AIFs, ETFs and private equity. It also offers full access and passporting capabilities to the EU, which is essential for fund distribution. In addition, there is a good network of double taxation treaties, including with the US.

One of the more popular models for private equity fund managers is the Irish Limited Partnership (ILP). ILPs, which can be established as Qualifying Investor AIFs, are easy to set up, tax transparent and regulated by the Central Bank of Ireland (CBI), enabling managers to market their products seamlessly across EU member states.

Luxembourg

Meanwhile, Luxembourg remains the second largest funds destination in the world behind the United States due to its stability, adaptability, investor friendly eco system and choice of fund structures. The most popular vehicle when establishing a private equity fund in Luxembourg is the Reserved Alternative Investment Fund (RAIF). One of the features of this structure that has led to the rise in popularity is it does not require managers to obtain approval from the local regulator, the Commission de Surveillance du Secteur Financier (CSSF) (meaning it can be set up within a few weeks), nor is it subject to ongoing CSSF supervision. There are also a large range of corporate structures available, including the FSP, SICAV, and SCS and SCSp. They can also make use of umbrella structures, enabling them to launch ring-fenced sub-funds which correspond to distinct assets and liabilities.

ELTIFs

More recently, private capital managers have been exploring the merits of whether to launch a European Long Term Investment Fund (ELTIF). Typically domiciled in Ireland or Luxembourg, ELTIFs provide the ability to market to both retail and professional investors, a significant advantage over other AIFs which can only be marketed to professional investors. This is especially important given recent fundraising challenges.

Owing to its semi-liquid nature and following recent improvements by EU regulators to the ELTIF framework under ELTIF 2.0, including the easing of restrictions on investing into non-EU assets and removing unnecessary barriers for entry, ELTIFs seem to be generating renewed interest.