At a JTC webinar, the panelists explained why success and failure in real estate investing can often come down to who really understands IRC Section 1031 and who doesn’t.

One of the most useful things about IRC Section 1031 is that because it can apply to so many different types of property held for business or investment use, it can be used by just as many different types of taxpayers: farmers, small business owners, commercial real estate companies with multifamily and office portfolios, corporations that own multiple retail sites, individuals with rental or vacation properties, and anyone invested in a Delaware Statutory Trust.

But 1031 is only useful if you know how to use it. To help exchangers better understand the ways in which Section 1031 can be employed, JTC gathered a group of 1031 exchange experts for The Future of 1031: Considering Exchanges Now and Long-Term. At this virtual event, the panelists shared some of the wisdom they’ve gained from years in the industry, including the questions they get asked the most about like-kind exchanges.

Understanding what types of property can be included in an exchange

Property owners who’ve done Internet searches on 1031 probably have a basic understanding that a 1031 exchange must involve “like-kind” properties. But as the panelists explained, people frequently misunderstand what it means for a property to be “like-kind.”

“That’s actually one of the most common questions that we do get,” said JTC National Sales Manager & Account Executive Justin Amos. “As long as it’s investment real estate to investment real estate, or business real estate, it’ll qualify from a 1031 exchange perspective.”

“I would say I answer that question more often than any other,” concurred Head of Specialty Administration & General Counsel USA Jill Jones. “There is misinformation out there where someone feels like, ‘if I sell a rental home, I have to buy another rental home.’

“Like-kind property is any kind of property that you’re holding for business or investment purposes,” she explained. “So you could go from a commercial building to a portfolio of rental homes. You could go into vacant land. It could be farmland. Again, any kind of real estate that’s held for business or investment purposes will qualify. You don’t have to match them exact for exact.”

“A lot of the times people do ask whether they can sell their single-family property for multifamily apartments or vacant land, which they absolutely can, and vice versa,” said JTC’s Nicole Walker, who went over what is not exchangeable, including personal property like a primary residence, personal-use vacation homes, aircraft, artwork, stocks, bonds, etc.

“Limited partnership or LLC interests, that is a big catch for people in 1031,” said Jones. Even though a multi-member LLC may exist solely to own property, it’s the LLC that owns that property; the individual partners own interests in the LLC, and those interests are not exchangeable.

“Look at how the property is held,” said Jones. “Is it held by a partnership or an LLC that has multiple members? If so, underneath that, the individuals don’t own the real property. Technically, they own an interest in that entity. And so steps need to be taken to either correct that prior to starting the exchange, or just to know that that wouldn’t be an exchangeable interest.”

“Multi-member LLC interests or partnership interests, those simply cannot be exchanged,” said Steve Ghirardo, Principal, Ghirardo CPA. “It doesn’t mean that it’s impossible to defer gain out of those situations where you have a multi-ownership LLC or partnership,” he added, with a word of caution: “There are ways to do it, but they take some time, and you gotta be careful.”

To go from a multi-member LLC to another ownership structure like a tenancy in common that allows for individual exchanges requires a process called a drop & swap. But as Amos noted, these transactions involve careful planning and proper documentation, especially if you live in a state where they’re seen as a red flag.

“If you’re a California real estate owner, the franchise board does not like those, especially closer to the sale,” he said. “Advanced tax planning is always preferable in any type of transaction, but specifically with the drop and swap.”

The many types of 1031 exchanges that are available

The panelists walked attendees through a few often-overlooked scenarios where Section 1031 can be employed. One of those situations is an exchange involving property located outside the United States, which is allowed so long as both the relinquished and replacement properties are located outside the U.S.

“We’ve been doing a lot more foreign exchanges,” said Walker. “There’s been definitely an uptick in those recently.” Because of the complications of various jurisdictions and tax regimes abroad, foreign-property exchanges require a certain type of global presence and experience to execute, which has made JTC a popular Qualified Intermediary (QI) to help with those kinds of transactions.

Another frequently-misunderstood type of exchange is the improvement exchange, where some of the sales proceeds are used to make improvements to the replacement property during the exchange period. This includes not just basic maintenance and upgrades, but potentially the construction of entirely new structures.

As Walker explained at the webinar, this provides flexibility because the exchanger doesn’t have to find a property valued at or above the one they’re selling. They could instead find a lower-valued property and use some of the sales proceeds for construction and upgrades, thereby utilizing their entire sales proceeds and achieving full tax deferral.

“It does need to be completed within that 180-day period, and the invoices have to be paid for completed invoices,” cautioned Walker. “So you want to make sure that your contractor is providing you with the correct information and that they’ve completed the work that they’re invoicing you for.”

An improvement exchange can be risky if the exchanger doesn’t think the work will be finished by the end of the exchange period. Pre-paying for labor or materials doesn’t count, so if you want to defer taxes on the full sales proceeds from the relinquished property sale, your construction must be completed by the deadline. If not, she said, “you can only utilize what part is actually completed.”

“You will get the deferral on the amount that is done,” added Jones. But for exchangers looking to defer capital gains taxes on their entire relinquished property value, the improvement exchange must be planned carefully in advance.

JTC’s exchange experts often get asked about vacation homes. Personal-use vacation homes are considered personal property, but those rented out through sites like Airbnb are valid business properties. So what about if you rent out your vacation home some of the year and use it yourself for other parts of the year? There are strict guidelines that must be followed.

“You can only use it for personal use either for 10% of the time that it has been rented or up to two weeks of the year,” said Walker, “so there are limitations on that piece.”

“If you do have a situation where you have a vacation rental and you’re using it part of the time for personal use, the number-one important thing for you to do is document, document, document,” said Jones. “How often were you there? Can you show marketing materials for when it was available for rent? The more evidence you have to support that your personal use was minimal and below the thresholds that Nicole pointed out, the better off you’ll be.”

Ghirardo recommended keeping personal use to a minimum in the two years leading up to when the property is to be sold.

“If you can limit your personal use for that time, while renting it out to others, then you meet the safe harbor provision to have that property qualify as 1031 and for full tax deferral, even though you may have used it personally a lot over the years preceding that two-year period,” he said.

Documenting personal and business use is also crucial for those hoping to combine a 1031 exchange with the Section 121 exclusion for a primary residence, which is possible for those who live on one part of the property and rent out another, or those who operate businesses out of the home.

“People forget their home-based businesses,” said Amos. “That may not be a huge chunk of their primary residence, but that does qualify.”

Ghirardo explained that for those with home-based businesses, it’s crucial to look back at previous tax returns to see how the property has been divided up between personal and business use.

“For example, farmers,” said Jones. “There’s a part of the property that is a homestead, where the house is, and there’s a part of the property that is for business and investment use. And so you can carve those apart separately to have the tax advantages for the homestead under Section 121, and for the business-use property under 1031.”

Like with other complex exchanges, the panelists stressed the importance of documentation, and of understanding the rules before starting the exchange. Getting competent tax and legal advice is a must in order to be sure your exchange will qualify.

The importance of a knowledgeable Qualified Intermediary

In terms of advice, the panelists were quick to point out that it helps to get started early.

“One of the things I love to touch on,” said Amos, “is Day Zero, and the amount of legwork you can do ahead of time, prior to the sale of the relinquished property.”

“The sooner you start, the better,” said Walker, who agreed she would “definitely encourage people to reach out, get their information, kind of try to get everything settled as soon as possible.”

“One of the mistakes I’ll see exchangers make, is they won’t let their real estate agent know,” said Ghirardo. As we’ve noted in the past, you can’t just sell a property and then decide to do an exchange. Speaking with your team and getting all documentation in order is crucial from the very beginning.

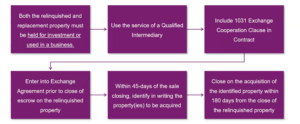

“Enlist the services of a Qualified Intermediary, first and foremost, before you do your sale,” said Walker. “That is very important. A lot of people ask that question, if they’ve done it after they’ve closed, and the answer is, no, you do have to enlist it and engage us before you do your sale. In the agreements, you should have a cooperation clause saying that the buyer and seller will cooperate, that this is part of the 1031 exchange, for both the relinquished and the replacement property.”

Amos stressed that when looking for a QI, you shouldn’t just find whichever one is the cheapest. Especially in the types of lesser-known scenarios talked about at the webinar, he said, you need a QI that can “guide you on how to pursue the type of transaction that would best fit your tax situation.”

That’s what makes JTC different from other QIs out there. We have a team with decades of experience across many thousands of transactions, including specialized expertise in reverse exchanges, improvement exchanges, and other complex scenarios. Whether you’re working with a Delaware Statutory Trust that’s involved in hundreds of exchanges per year, or you’re a farmer looking to move to a new plot of land, JTC can provide you with the same level of expertise, personalized service, and institutional-grade security to help your exchange succeed.

The panel also discussed permissible exchange expenses, tax straddling, how long you should hold a property before performing a 1031 exchange, how recent events like the California wildfires affect 1031 exchanges, and plenty more. Check out the webinar to learn how understanding the rules of 1031 could be the key to a successful investing strategy.

Stay Connected

Stay up to date with expert insights, latest updates and exclusive content.

Discover more

Stay informed with JTC’s latest news, reports, thought leadership, and industry insights.

Let’s Bring Your Vision to Life

From 2,300 employee owners to 14,000+ clients, our journey is marked by stability and success.