Investors

Why JTC?

8 Reasons to Invest in JTC

Our investment case is built on Shared Ownership, experienced management, strategic acquisitions and a robust governance structure.

Our Long Term Track Record

Through our 37-year history of strong performance, we’ve combined organic and inorganic strategies to deliver consistent revenue and profitability growth. We take a long term view.

Revenue CAGR Last 10 Years

Net Organic Growth

Three-year LTM average

Inorganic Growth

Three-year LTM average

Share Price CAGR Last 6 Years

As at October 2024

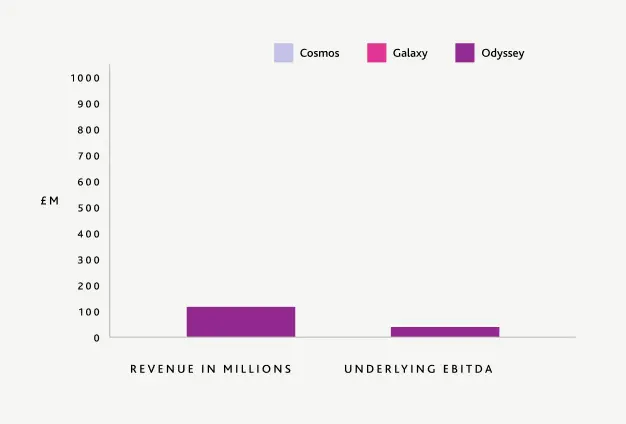

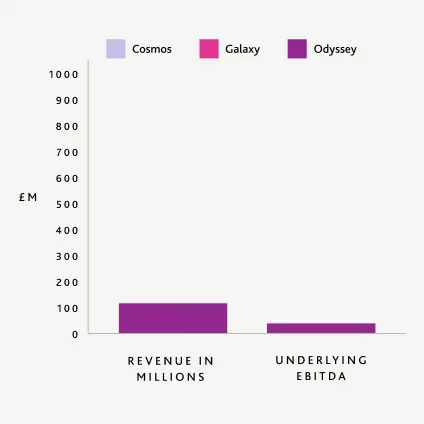

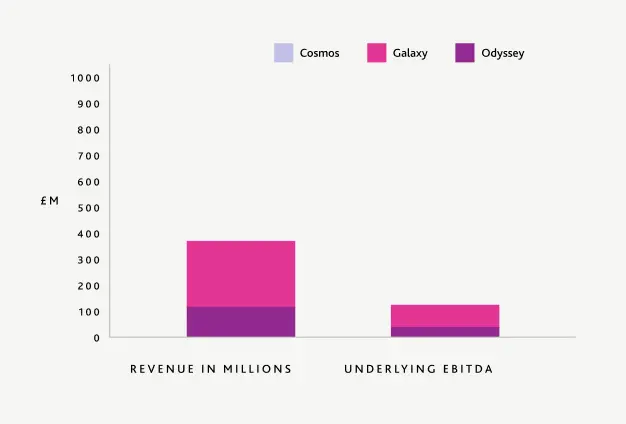

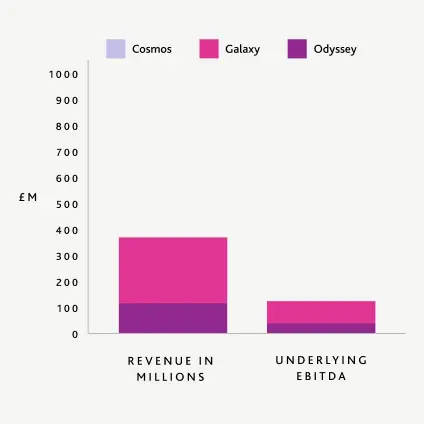

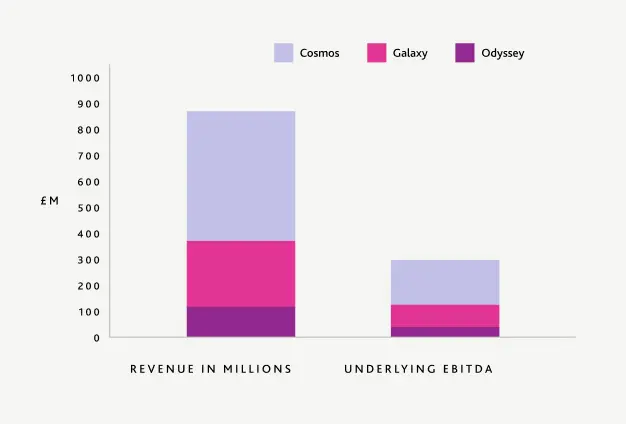

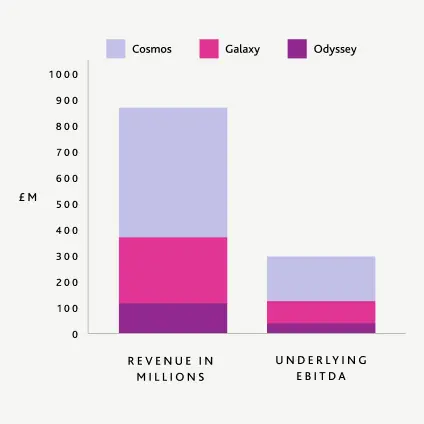

2024 Financial Highlights

For the period 1 January – 31 December 2024

Revenue

Net Organic Revenue Growth

Profit Before Tax

Underlying EDITDA

New Business Wins

Underlying Earnings Per Share*

Lifetime Value Won

Underlying EBITDA Margin

Dividend Per Share

Accelerating Together

We run JTC using multi-year business plans that we call eras. They are named for clear identity to support communication, strategic alignment and goal setting across the Group. Each era represents a step-change in growth, innovation and market presence. This forward-thinking strategy ensures that we remain resilient, adaptable and aligned with our long term goals.

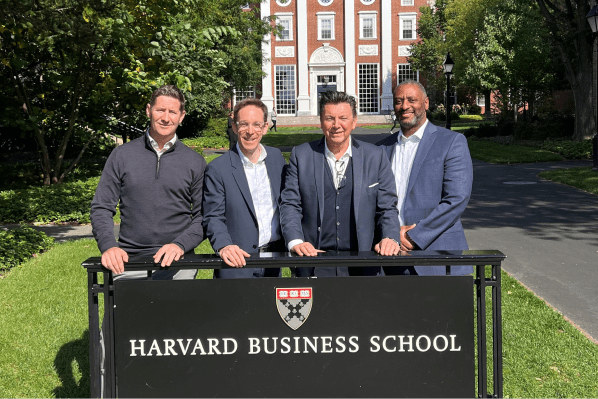

JTC Shared Ownership

People Are Central to JTC

Shared ownership is central to JTC’s culture and success. Since 1998, our Employee Benefit Trust has aligned employee and shareholder interests and generated over £450m of total value for employee owners. This model empowers our people, supports our client-first approach and drives exceptional results.

Our programme is the subject of a Harvard Business School MBA case study.

Meet Our Board

Learn more about the Board of directors who guide JTC’s strategy to ensure sustained growth and stakeholder value.

Subscribe to Receive Our Updates

Sign up to receive the latest financial news and announcements from JTC in your inbox.

Learn More

Discover how we create sustainable growth and value for all our stakeholders. Please get in touch with our team if you have any specific questions.