Comprehensive Fund Solutions

JTC’s range of fund solutions deliver expert support at every stage of your fund’s life-cycle, ensuring operational efficiency, investor confidence, and compliance across multiple jurisdictions and structures.

Administering over $160 billion of fund assets, JTC combines global reach, decades of fund expertise, and direct access to a committed team with exceptionally low turnover to support your success.

Fund Assets Under Administration

Managing fund assets globally across diverse jurisdictions.

Funds Under Depositary

Specialist depositary services covering alternative investment funds.

Depositary Assets

Regulated AIFMD depositary oversight with FCA and CBI accreditations.

Employee Ownership

Our Shared Ownership model drives accountability, stability, and innovation.

Complexities of Fund Services

Navigating fund services requires exceptional expertise in compliance, cross-border regulations, and investor reporting. Our solutions ensure precision, transparency, and efficiency at every stage of your funds’ life-cycle.

Find Your Local Team

Your Fund Solutions Experts

JTC’s fund services provide dedicated access to industry-leading professionals, ensuring consistent client support through our highly engaged Fund Services teams and low staff turnover.

Frequently Asked Questions

Our employee ownership model fosters accountability and innovation, ensuring clients receive consistent, high quality service throughout their fund’s life-cycle.

We are personally invested in helping you because your success is our success.

JTC provides services for private equity, real estate, venture capital, private credit, alternatives, traditional and fund of funds.

JTC provides a range of services including but not limited to NAV calculations, regulatory reporting, investor relations, governance, and fund formation, tailored to meet your specific requirements.

With a highly invested team, low staff turnover, and a culture of Shared Ownership, JTC ensures long-term client relationships with access to dedicated experts who understand your fund and investors’ needs.

JTC integrates best-in-class third party technology to enhance efficiency, ensure accurate reporting, and provide secure access to fund data for you and your investors.

JTC’s Global AIFM Solutions provide fund promoters and investment managers with regulatory oversight, risk management, portfolio management and compliance support, ensuring full alignment with AIFMD and evolving jurisdictional requirements.

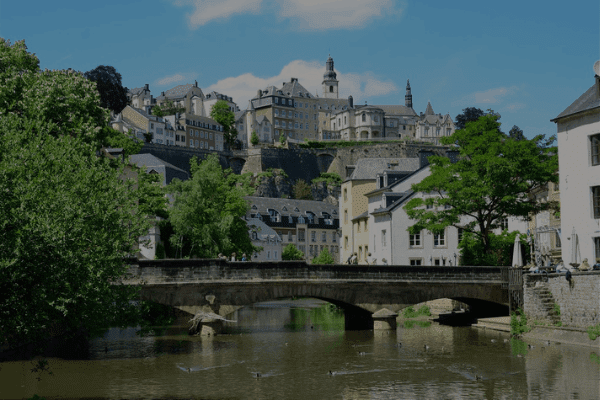

JTC can support you across multiple asset classes in the US, Europe, the UK, Ireland, the Channel Islands, the Caribbean, the Middle East and Asia.

perfORM Due Diligence Services Limited (perfORM), a JTC Group company, is an award winning, multijurisdictional and standalone provider of Operational Due Diligence Services with 125+ years of collective ODD experience. perfORM offer a pragmatic ODD Report Solution to Investment Managers directly. The resulting ODD report will be available to all their chosen clients and prospects, significantly reducing the amount of time spent managing inbound due diligence requests.

JTC’s Banking & Treasury team provide comprehensive support to fund managers by streamlining banking operations, optimising liquidity, and managing financial risks. Our services include:

-

- Banking Relationships & Account Management: We leverage our extensive network of banking partners to assist with account opening, ongoing administration, and transaction management.

- Treasury & Cash Management: We help fund managers manage liquidity efficiently, ensuring capital is deployed effectively while mitigating cash drag.

- FX & Payment Solutions: We facilitate international payments and foreign exchange services to support cross-border fund structures.

- Tailored Solutions: Our team work closely with fund managers to create bespoke treasury strategies that align with their investment objectives and operational needs.

By integrating our expertise with JTC’s broader fund administration capabilities, we provide fund managers with a seamless and efficient financial infrastructure, allowing them to focus on investment performance and growth.

Explore the Latest

Explore the Latest

Your Fund Solutions Experts

JTC’s fund services provide dedicated access to industry-leading professionals, ensuring consistent client support through our highly engaged Fund Services teams and low staff turnover.

Explore the Latest

Explore the Latest

Your Fund Solutions Experts

JTC’s fund services provide dedicated access to industry-leading professionals, ensuring consistent client support through our highly engaged Fund Services teams and low staff turnover.

Explore the Latest

Your Fund Solutions Experts

JTC’s fund services provide dedicated access to industry-leading professionals, ensuring consistent client support through our highly engaged Fund Services teams and low staff turnover.

Your Fund Solutions Experts

JTC’s fund services provide dedicated access to industry-leading professionals, ensuring consistent client support through our highly engaged Fund Services teams and low staff turnover.

Explore the Latest

Explore the Latest

Explore the Latest

Explore the Latest

Explore the Latest

Explore the Latest

Your Fund Solutions Experts

JTC’s fund services provide dedicated access to industry-leading professionals, ensuring consistent client support through our highly engaged Fund Services teams and low staff turnover.

Explore the Latest

Your Fund Solutions Experts

JTC’s fund services provide dedicated access to industry-leading professionals, ensuring consistent client support through our highly engaged Fund Services teams and low staff turnover.

Explore the Latest

Explore the Latest

Your Fund Solutions Experts

JTC’s fund services provide dedicated access to industry-leading professionals, ensuring consistent client support through our highly engaged Fund Services teams and low staff turnover.

Explore the Latest

Your Fund Solutions Experts

JTC’s fund services provide dedicated access to industry-leading professionals, ensuring consistent client support through our highly engaged Fund Services teams and low staff turnover.

Explore the Latest

Your Fund Solutions Experts

JTC’s fund services provide dedicated access to industry-leading professionals, ensuring consistent client support through our highly engaged Fund Services teams and low staff turnover.

Explore the Latest

Your Fund Solutions Experts

JTC’s fund services provide dedicated access to industry-leading professionals, ensuring consistent client support through our highly engaged Fund Services teams and low staff turnover.

Your Fund Solutions Experts

JTC’s fund services provide dedicated access to industry-leading professionals, ensuring consistent client support through our highly engaged Fund Services teams and low staff turnover.

Explore the Latest

Explore the Latest

Your Fund Solutions Experts

JTC’s fund services provide dedicated access to industry-leading professionals, ensuring consistent client support through our highly engaged Fund Services teams and low staff turnover.

Explore the Latest

Explore the Latest

Your Fund Solutions Experts

JTC’s fund services provide dedicated access to industry-leading professionals, ensuring consistent client support through our highly engaged Fund Services teams and low staff turnover.

Your Fund Solutions Experts

JTC’s fund services provide dedicated access to industry-leading professionals, ensuring consistent client support through our highly engaged Fund Services teams and low staff turnover.

Explore the Latest

Explore the Latest

Your Fund Solutions Experts

JTC’s fund services provide dedicated access to industry-leading professionals, ensuring consistent client support through our highly engaged Fund Services teams and low staff turnover.

Explore the Latest

Explore the Latest

Connect with a JTC Fund Expert

Discover how JTC’s tailored fund solutions help you achieve your goals. Contact our team to learn more about our global solutions and expertise.

Recognised Excellence in Fund Services

Stay Connected

Stay up to date with expert insights, latest updates and exclusive content.